What Is Making Tax Digital?

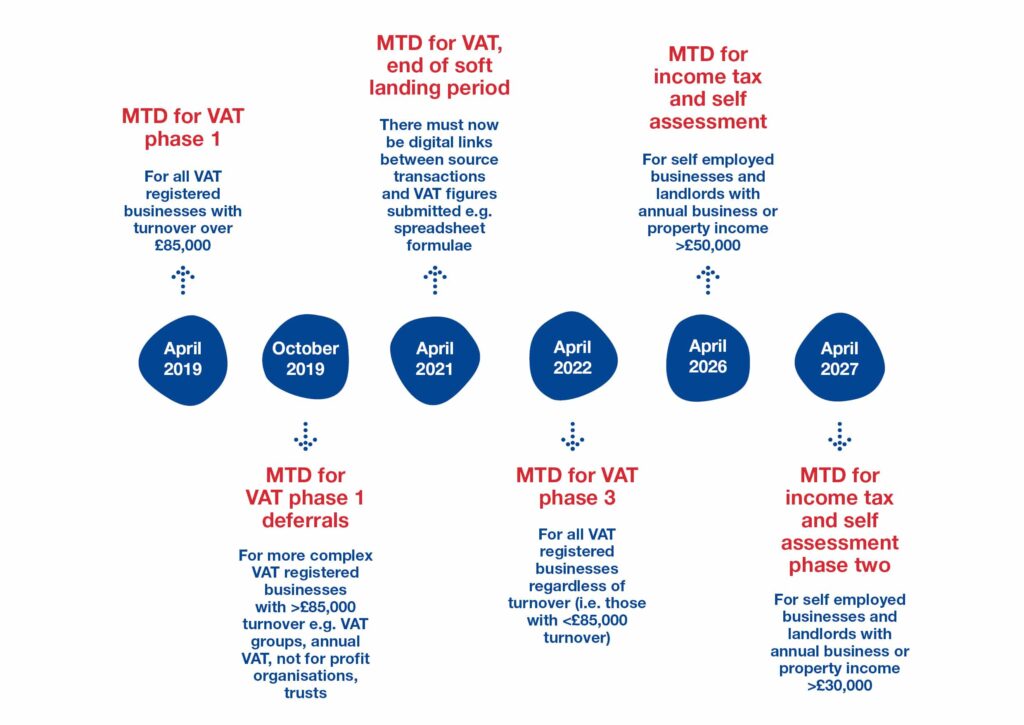

The UK tax system is undergoing a major transformation with Making Tax Digital (MTD), an initiative by HMRC to streamline and modernise tax reporting. If you’re a sole trader earning over £50,000, these changes will directly impact you. Here’s everything you need to know to stay ahead.

✅ 6 April 2026 if you have an annual business or property income of more than £50,000

✅ April 2027 if you have an annual business or property income of more than £30,000

Image from PKF Francis Clark

Making Tax Digital is part of HMRC’s goal to create one of the most digitally advanced tax systems in the world. The idea is simple: businesses and individuals must keep digital records and submit tax returns electronically using MTD-compliant software.

For many businesses, this is a natural shift. Online banking, digital invoicing, and cloud-based accounting are already common. MTD eliminates paper-based processes, reduces errors, and gives businesses more control over their financial planning.

How Will MTD Affect You as a Sole Trader?

If your annual self-employment income exceeds £50,000, you’ll need to comply with MTD for Income Tax Self-Assessment (MTD for ITSA) starting in April 2026. Here’s what changes:

✅ Quarterly tax reporting: Instead of one tax return per year, you’ll submit income and expenses four times a year.

✅ Digital record-keeping: Paper records won’t be accepted. You must use MTD-compliant software to track your finances.

✅ End-of-year submission: A final submission will confirm your total tax liability.

✅ No change to payment deadlines: Tax payment deadlines remain the same, even with more frequent reporting.

In April 2027, MTD will extend to sole traders earning between £30,000 and £50,000.

Steps to Get Ready for MTD

Preparing for MTD now will make the transition smoother. Here’s a simple step-by-step guide:

1. Check if You’re Affected If your total income from self-employment and rental properties exceeds £50,000, you’ll need to comply by April 2026.

2. Consider Exemptions Some businesses may be exempt due to age, disability, or remote location. If you already have an MTD VAT exemption, it applies to ITSA too.

3. Separate Business & Personal Finances Having a dedicated business bank account makes tracking income and expenses easier, ensuring smooth MTD compliance.

4. Understand Tax Basis Reform From 2025-26, HMRC will align all ITSA reporting periods to the same quarter-end dates. If your business has a non-standard tax year, this could impact your tax bill.

5. Choose MTD-Compatible Software Popular options like Xero, QuickBooks, and FreeAgent can simplify compliance. Speak to your accountant to find the best fit for your business.

6. Get Support Your accountant can guide you through software setup, tax submissions, and quarterly reporting.

Why Act Now?

Waiting until the deadline could make the transition stressful. Switching to digital record-keeping now will:

✔ Save time by reducing manual paperwork.

✔ Minimise errors with automated calculations.

✔ Provide real-time financial insights to improve cash flow management.

✔ Ensure compliance and avoid last-minute panic.

Final Thoughts

Making Tax Digital is a shift towards a more streamlined, efficient tax system. While it requires some initial adjustments, it can ultimately make tax management easier and more transparent.

Need guidance on how to prepare? Let’s chat! I can help you choose the right tools and strategies to make your MTD transition seamless.